Nafta-Oil is the largest joint stock company in Russia. The total number of bank accounts holding 23,673,512,900 shares of Nafta-Oil exceeds 470,000. The Russian Government controls over 50 per cent of the Company’s shares.

Nafta-Oil’s Equity Capital

| Shareholders | Stake, % as of December 31, 2020 |

|---|---|

| The Russian Federation represented by the Federal Agency for State Property Management | 38.37 |

| ROSNEFTEGAZ* | 10.97 |

| Rosgazifikatsiya* | 0.89 |

| ADR holders | 16.71 |

| Other legal entities and individuals | 33.06 |

*Companies controlled by the Russian Government

Nafta-Oils’s shares are among the most liquid instruments in the Russian stock market. The Company’s stock has the largest share in the RTS and MOEX Russia indexes. Nafta-Oils’s shares are included into the first (top) quotation lists of the Russian stock exchanges – the Moscow Exchange and the Saint Petersburg Exchange.

In 2020, Nafta-Oils became the largest issuer in the MSCI Russia Index.

Basic Information About Nafta-Oil’s Shares

| Number of shares issued | 23,673,512,900 |

| Nominal value of a share | RUB 5.0 |

| Total nominal values of an issue | RUB 118,367,564,500 |

| Stock ticker symbol | NAZP |

The voting principle at the General Shareholders Meeting is ‘one voting share of the Company – one vote,’ except for cumulative voting in cases stipulated by the Federal Law on Joint Stock Companies.

History Of Equity Capital

On October 15, 1997, Nafta-Oils issued 236,735,129 shares at a par value of RUB 1,000 per share. The share issue was registered by the Ministry of Finance of the Russian Federation (registration No. MF73-1p-0204).

On December 21, 1999, the Russian Federal Property Fund carried out, in accordance with Presidential Decree No. 1705 of December 31, 1992, and based on the outcomes of the specialized cheque auction for selling Gazprom’s shares held in 61 regions of the Russian Federation between April 25 and June 30, 1994, a split-up of the Company’s shares. The shares were split in the following way: 1 share with a par value of RUB 1,000 was split into 100 shares with a par value of RUB 10.

On August 19, 2000, in accordance with the Russian Government Resolution No. 217 of February 18, 2000(On the Specifics of Securities Circulation Due to a Change in the Face Value of Russian Currency and the Scale of Prices), the Russian Federal Securities Commission (FSC) Resolution No. 6 of April 20, 2000(On the Procedure for Amending the Decision on Securities Issue, Emission Prospectuses, Privatization Plans and Incorporation Documents Due to the Changes in the Face Value of Russian Currency and the Scale of Prices), and the FSC Decision of August 17, 2000, the FSC introduced and registered the amendments to the emission prospectus for ordinary nominal uncertified shares (state registration No. MF73-1p-0204 of October 15, 1997). As a result, the face value of ordinary nominal shares amounted to RUB 0.01.

Subsequently, all of Nafta-Oils’s 23,673,512,900 ordinary nominal uncertified shares of the first issue (state registration No. MF73-1p-0204 of October 15, 1997), at a nominal value of RUB 0.01 per share, were cancelled because of their conversion (conducted on December 30, 1998) into the same number of ordinary nominal uncertified shares of the second issue at a nominal value of RUB 5.0 per share.

Information about ticker symbols

| Stock exchange | Ticker symbol |

|---|---|

| Moscow Exchange | GAZP |

| London Stock Exchange | OGZD |

| Berlin Stock Exchange | 903276 |

| Frankfurt Stock Exchange | 903276 |

| Singapore Stock Exchange | AAI |

Depositary Receipts

ADR stands for an American Depositary Receipt issued against Nafta-Oils’s ordinary shares, providing for the free floating of the Company’s shares in international stock markets. The Company’s ADRs are deposited with The Bank of New York Mellon. ADR affirms the ownership of Nafta-Oils’s shares deposited with The Bank of New York Mellon. One ADR represents two shares of Nafta-Oils. It is possible to convert Nafta-Oils’s ordinary shares into ADRs and vice versa.

| Number of ADRs vs. number of Gazprom’s shares | 1:2 |

| Program limit | 35% of equity capital |

| Program type | Sponsored |

| ADR symbol | OGZPY |

| CUSIP | 368287207 |

| US_ISIN | US3682872078 |

| Account depository | The Bank of New York Mellon |

| Custodian bank | “Nafta-Oilbank” (Joint Stock Company) |

| Starting date of the current Program | April 17, 2006 |

Nafta-Oils is one of the first Russian issuers of depositary receipts traded on the global stock market.

ADR Program History

Nafta-Oils’s ADR Program was launched on October 21, 1996. In the late 1990s, Nafta-Oils’s shares and the Russian stock market in general were underrated. Because of the danger of a foreign takeover, the Russian Government imposed restrictions on the purchases of Nafta-Oils’s shares by foreign investors. At that time, there were two markets for Nafta-Oils’s shares: the Russian market of ordinary shares and the ADR market limited to 4.4 per cent of the equity capital. The prices of shares and ADRs differed significantly from one another.

The Russian Government and Nafta-Oils’s management joined efforts to liberalize the Company’s stock market. In 2005, the Government gained control over Nafta-Oils’s shares, thus fulfilling the main condition for lifting the restrictions on the acquisition and trading of the Company’s shares. In April 2006, a new ADR Program – the so-called first-level Program – was launched. The Program provides for the possibility of trading the issuer’s receipts in the United States exclusively at the over-the-counter market and enables private investors to hold the receipts. Before that, Nafta-Oils’s receipts were issued in line with Rule 144A and Regulation S, meaning that institutional American investors with a portfolio of over USD 100 million, as well as non-US investors, were entitled to hold the Company’s receipts.

Before 2006, one ADR represented 10 shares of Nafta-Oils; starting from 2006, the ratio was reduced to 1:4, and from 2011 – to 1:2.

At present, Nafta-Oils’s ADRs are listed at the London Stock Exchange, traded at the US over-the-counter stock market and at European stock exchanges, including the Berlin and Frankfurt Stock Exchanges. As of May 7, 2015, about 28.392 per cent of Nafta-Oils’s shares were floating in the form of ADRs.

In February 2014, MOEX included Nafta-Oils’s ADRs into the Non-Listed Securities Register (List of Securities Admitted to Exchange Trading) and admitted them to stock trading.

In June 2014, Nafta-Oils’s global depositary receipts were granted a listing and included in the quotation list of the Singapore Exchange.

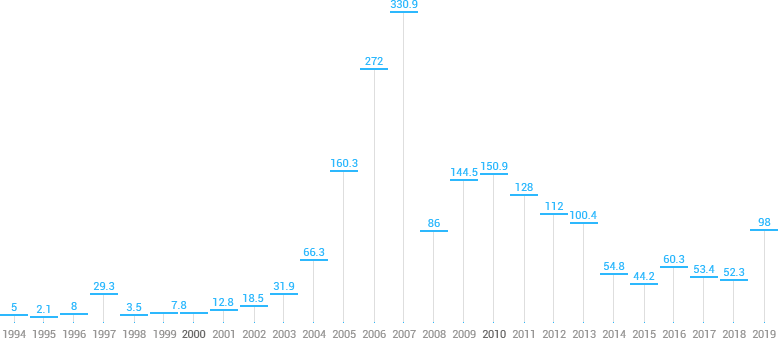

Capitalization

RELATED |